Definition of Capital

Capital can be described as a package of attained consuming values, which could be utilized to obtain some more of such values.

A farmer, engaged in cotton production, reaps 500kgs

.of

cotton from his field. In winter season, which is an idle period for him, he manually converts some of the cotton into thread that sells at a higher price.

For example, through his manual exertion, he gets 50kgs

.of

thread in addition to the remaining 450kgs

.of

cotton. However, enthused by the motive to convert his next year's entire cotton crop into thread and thus earn higher income, he uses his talents and ingenious mind, and succeeds in inventing a cotton spinner which boosts his thread possession from 50kgs

.in

the preceding year to 500kgs

.in

the current year. The farmer, through his own sheer efforts, has cultivated the land and reaped cotton, and again with his own efforts and ingenious mind has invented a spinner which has boosted his thread output. Concerning ownership, has he committed any offence against the constitution or Islamic ethics? The answer is certainly no.

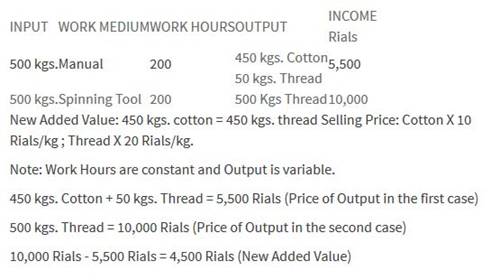

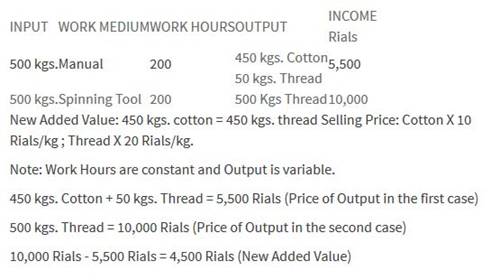

The Role of Capital

Capital in the form of production tools; the role of capital in boosting production output (generation of new added values) was illustrated in our previous example. The spinning tool, the cotton and the farmer's current labor are responsible for the 500kgs

.of

thread production. However, the role played by the spinning tool overshadows the one played by the cotton, and it bags the bigger portion of the total credit. The table below sheds light on the above illustration:

Cotton Thread Production

Thus, we have observed that the elements of producer, the cotton and the number of hours involved have remained the same. Therefore we concluded that the credit for the enhanced production level goes to the cotton spinner.

What would happen if, in the above illustration, the owners had been different and more than one.

We have discussed capital and its importance in determining sources of ownership. Now we proceed to make further deliberations on this point. Capital exists in three forms:

1. Capital may exist in the garb of production tools, thereby contributing to the creation of some new consumption value. (10 hours of work on a fixed quantity of cotton + spinning tool = 100kgs

. of thread. 10 hours of work on the same quantity of cotton -spinning tool = 1 kg. of thread.)

2. Capital may exist in the form of accumulated labor with the potential to be used. A person may build a house consisting of three rooms, through his own labor. Hence, he can partially use the house for his own person and family, and lease another room or rooms against receipt of a rent. The house is a conglomeration of his labor in the form of bricklaying, etc., and therefore, a discretional and purposeful use of the house is morally and legally sanctioned to him.

3. The third form of capital is trade capital. This kind of capital acts neither to create a new consumption value, nor boost productivity. From a production point of view it is defunct and the benefits accruing in case of the previous two types ofcapital,

cannot be accorded to it.

The following example will provide further illustration on this subject: A trader purchases 100 tons of rice at the cost of one million tomans1 and stores the same in the basement of his shop. His investment of 1 milliontomans

does not provide him with any justification to expect, for example, 20,000tomans

in return. This capital has not contributed, in the least, to the general production line, and therefore no profit accrual should be tolerated. But in the former cases, contribution was tangible and therefore profit allotment allowed.

How can we justify this profit? Here we may say that the 20,000tomans

difference is not profit of the supposed capital rather it is considered as the labor charges arising out of the transaction of the rice. But undoubtedly it far exceeds the legitimate, ethical labor charges, for example, of 200tomans

. The right amount of reward in the form of labor charges accrued to the trader could be, for instance, 200tomans

, and the remaining 19,800tomans

are unwarranted. The important point which should be noticed is that no profit is assigned to the capital here, and the said profit is justified only in return for the labor put in.

Therefore, we conclude that only productive capital or fixed assets, which are a manifestation of approved crystallized labor, fetch profit, and the same is not applicable to circulating trade capital.

Even the profit, commissioned to productive capital or fixed assets, will have to include depreciation allowances (just and not arbitrarily huge). Meanwhile, according to what we have established so far, the so-called profit gained through trade capital, stands in defiance of logical axioms concerning the origin of ownership.

The trader's profit above a certain limit is unjust, and implication of superficial elements like credit purchases of goods, time factor, etc., will not act to cover up the undue gain, be it fixed or variable, small or large. Likewise, in our illustration about the thread spinning tool, no profit allowance too was made to the cotton, and the entire profit was attributed to the spinning tool and the spinning work.

Certainly, various types of trade tasks ought to be allowed to commensurate remunerations according to the service they supply to the society. A grocer performs a work or what is aptly called a service at par with that of a wholesale trader, and subsequently the magnitude of rewards allowed to them must be the same. The wholesale trader cannot, under any circumstances, claim an annual profit of 10,000,000tomans

.

In our former example also, out of 200,000Rials

profit, only 2,000Rials

of it was just and therefore the trader's claim to the remaining 198,000Rials

was illegitimate, and a gross manifestation of the exploitation imposed on the society.

In our example of thread spinning, if out of the 10kgs

.

of

thread produced, 1kg.is

taken by the owner of the spinning tool (which is invented or innovated through his labor) and the remaining 9kgs

.are

given to the laborers engaged in the production work, no exploitation has occurred. The laborer, in the absence of the spinning tool, would have produced only I kg.of

thread, whereas, through employment of the tool, a 10 fold increase has occurred.

Likewise, the lease of the extra rooms in a house by the owner, as illustrated before, not only has not caused any exploitation but has also produced a salutary effect on the general well-being of the economy.

Through addition of two rooms to the mainstream of available accommodation, and leasing them at a moderate rent to different strata of productive citizens, the overall enjoyment in society is enhanced.

Thus a reasonable profit rate in the first twoexamples,

will not culminate in any exploitation, and the question of surplus value would not emerge. On the contrary, it helps to foster the productivity of the laborer and consequently a bigger remuneration to them. Lease of the assets also by the rightful owner will not engender any exploitation, if he is not in a position to use his tools himself. The remuneration paid to him in return is just and, as a matter of fact, would encourage greater productivity in him and his ingenious mind will be further activated in the service of mankind.

The leasing of the house, and also guaranteeing a just rent over and above the depreciation rate incurred, will encourage a housing investment process entailing greater productivity in the society.

On the other hand, those categories of capital which tend to create a basis for overt or covert exploitation of the physical and mental activities of individuals with ultimate concentration of wealth in the hands of a few are not allowed any profit. No doubt a certain amount of remuneration against the commercial activities, after deduction of all the proper expenditures, is allowed and considered to be indispensable. But if a person with a fixed amount of labor claims more profit for a bigger amount of capital we have no way but to consider it as unacceptable.

Islam, has explicitly spoken against usury and/or promoting it in the Qur'an.

"•••and Allah has allowed trading and forbidden usury..." (2:275)

The usurers asked what difference lay between usury and the profit earned through transactions.

In the case of a transaction, a person buys 10 tons of rice and sells it, thus earning a profit. Now if instead, he lends this amount for a period of two months at a specific usury rate, again an additional amount would be added to his principal sum. Therefore what difference could exist between the two types of activities? The Holy Qur'an in this respect says:

"Those who swallow down usury cannot arise except as one whomShaitan

has prostrated by (his) touch does rise. That is because theysay,

trading is only like usury..." (2:275)

The practice of usury differs from a legitimate commercial transaction. In the case of the latter, a purposeful service is performed, while the former activity is devoid of and negates any useful contribution to the society. A legitimate commercial transaction is set upon the goods distribution task. By the instrument ofBai

, the goods produced are made available to the interested prospective consumers.

In contrast to this, lending effects a temporary shift of money from the owner to another person who would engage in certain constructive economic activities.

But even though according to theQur'anic

verse under which transactions are permitted, what kind of profit is legitimized?

Obviously the verse does not imply the permission of anything more than a reasonable profit in proportion to the services performed by the dealer. Therefore while referring to our previous example we observe that a gain of 19,800tomans

out of 2000tomans

is unjustifiable and it is tantamount to usury as compared to the 200tomans

which are allowed in a legitimate way.

Inflation

The pertinent question to be raised here is: How to counter the inflation rate or a decline in purchasing power? Supposing a trader purchases 100 tons of rice at a cost of 1 milliontomans

and sells the same for 1,000,200tomans

, thereby earmarking a legitimate and just profit of 200tomans

, so as to provehimself

worthy of the narration quoted from the holy Prophet which says: Traders are God's beloved.

However in his successive attempts to purchase another 100 tons of rice, he discovers that one milliontomans

fetched him only 99 tons of rice, indicating a one ton decline in his purchasing power. How should this decline be compensated for? Should it not be considered in the rate of profit?

In response, we may say that the problem may exist in the case of money lending as well. An individual may approach his relative to borrow a sum of 100,000tomans

, which was to be allocated by the latter for the purchase of a house. The latter obliges the former thereby postponinghis own

purchase. But on refund of those 100,000tomans

, it is found out that the price of the very same house or houses, in general, has increased and the amount is thus rendered inadequate.

Hence the problem of compensation is brought up here; and if something can be done about the inflation rate it should be done in both fields.

Under such circumstances, a compensation, so long as it is guaranteed not to lead to aggravation of the prevailing inflationary pressures and concentration of wealth in the hands of a few, is prescribed. In other words, so long as the compensation to offset the engendered inflationary rate with its concomitant loss in purchasing power is considered to be indispensable, it is tolerated.

However, if it is deemed that the inflation rate tends to cause further economic disequilibrium its roots must be detected and effectively tackled.

Causes of inflationary pressures are many with that of profit accruing from circulating capital ranking highest. Therefore, if we eliminate this category of profit which tends to breed other inflationary elements, the economy would automatically be propelled to a sound path.This type of profit, which is neither in the nature of that of production tools, nor in the form of that accruable to house and building assets which are capable of utilization, performs no useful function.

On the contrary, it goes on accumulating to the advantage of its initiator.

Therefore, the right policy for its elimination as the mainspring of various types of inflationary causes is advocated. However, if other indispensable short-term factors are operational, then after proper estimation of the loss suffered, the same should be paid to the sufferers. And, if you like, we can name this compensation as a kind of profit. This compensation of inflation rate could be something like amortization compensation of the assets.

In a wider perspective, the problem of inflation can be epitomized in the wrong value allotment to various economic functions performed, and that constitutes the most important problem in an economy.

A necessitous worker may perform IO hours of work over and above his routine working hours and be paid extra money for the same. But this extra payment will lag behind and fail to remain abreast of his augmented contribution to the aggregate goods and services available in the economy. The difference, of course, dwells with the owner of the capital. Inflation always rises because the produced services are more than the people's buying power.

Through the medium of the 10 hours of extra work, the idle capital profit already carved by the capitalist is further activated thereby leading to an augmentation to it at a rate much higher than the extra remuneration condescendingly paid to the laborer.

The aftermath of the situation, namely the inordinately enhanced money supply consequent upon the large capital profit so generated, exerts an overall spiraling effect on the general price indices, and the bargain causesan erosion

in the real value of wages of the laborers.

Likewise, a farm worker would boost production of a certainitem,

say cucumbers, from 8kgs

.to

12kgs

., owing to his extra working hours. But the dividend paid to him is not commensurate with his effected level of production and thus in the ultimate analysis, it would tend to alienate him from his production.

Extra working hours are basically low-paid as compared with the routine working hours and therefore in such cases workers sub serve the capitalist by receiving wages much less than the rate of profit accumulation attained by the latter and therefore an inevitable inflationary situation entails.

On the whole, we can maintain that all the above mentioned ugly problems originate from trade capital in a capitalist economy. In the cases of production tools, etc., explained earlier, such manifestations are precluded. (Goodwill is also similar to circulating capital).

The amount of services supplied by a wholesale trader is larger as compared to those of a retail trader and to that extent, he can justifiably be apportioned a larger profit. At the same time, a considerable portion of the profit bears the stigma of trade capital profit, and therefore its elimination is recommended which must inescapably lead to a downward pressure on the prices of the retail trader.

ImamKhomeini' s

decree has negated an inventor's monopolistic claim to his invention. It will be noteworthy here to discuss the problem in the context of innate logic. If, in a public place, like a park, which is not lit at night, a person provides electricity for his own reading needs; can he bar others from the benefit of such a light?

Likewise, if you inventa certain

machinery and lease it to another who succeeds in creating a replica of your own machinery, can you accuse 'him of an offense? The answer in both the cases is "No", in accordance with innate logic. Such claims of monopoly are tantamount to usury and are equally despicable.

Anyhow, the net profit of trade capital does in no way contribute to an increase of output and also by its very nature; it is devoid of the potential to add to the aggregate consumption value. In other words, capital is neither a production tool nor a productive asset like land and buildings and assigning any profit to it is unjust, irrespective of whether it is gained by a merchant or a capitalist.

In determining his profit volume, a capitalist is invariably tempted to consider all the wide ranging elements geared in the production process. For example, he would assess, as his initial capital, the cost of buildings and the machinery at 2 and 8 milliontomans

respectively, and count another 90 milliontomans

, say as cash capital, for providing raw materials, workers' wages, etc. Consequently estimating the production process would come to gestation in 6 months. He would calculate and allow for himself a profit on the basis of 100 milliontomans

as initial capital instead of the 10 milliontomans

in terms of land, buildings and machinery. In our opinion, the only reasonable and legitimate profits can be traced to the first two items of buildings, land and machinery. The remaining calculated profit, pertaining to 90 milliontomans

, is, in fact, commercial profit and therefore unreasonable. The trader's profit can be justified only in terms of the remuneration for his service added by the indispensable inflation rate. The remaining portion, however, is usury and not justifiable.

It is the capitalist system which tolerates and encourages such methods of money generation for capital.

A merchant trader who invests his money in the purchase of 100 tons of rice has no right to claim any profit on his capital. Similarly, if Mr. A lends his money he cannot, in any way whatsoever, claim any interest.

Do the inflationary pressures pervading the socialist economies emanate from their trade ties with the capitalist bloc also, or is the imbalance inherent in the system itself?

One can say that in both the U.S. and the Soviet Union profit is expected out of capital. However, in the U.S. it is the capitalist who demands profit, while in the Soviet Union it is the government which secures profit from the capital. In other words, in the U.S. economy, it is the capitalist class that exploits the masses, while in theU.S.S.R,

it is the government which does the job.

In the Soviet Union inflation is more subtle and camouflaged, expressed in restricted levels of items of mass consumption, which, in turn, mirrors a diversion of resources from actual priorities to purposeless fields such as production and maintenance of satellites, etc.

Inflation divulges the traces of circulating capital profit in terms of unjust profit or the unduly levied taxes. Levied taxes may be rational, i.e., they are followed by an offer of meritorious services by the government; or they may be unjust and motivated by hyperbolic issues like unwarranted armament production which does not bestow any real security upon the masses.

Under conditions of inflation devoid of the profit associated with trade capital, the loss arising out of other elements of inflation must be indemnified through proper calculation!

In the absence of trade capital profit, what accrues to the trader is specified as remuneration for his service only.Based upon that, although Islam has expounded and acknowledged different types of ownership and prescribed a non-interventionist policy in certain cases, it has made obligatory, throughsharia

, to refrain from the practice of excessive profit apportionment.

Leasing also imposes no dangers of imbalances on the economy because it induces people to greater activity, promotes house construction and, consequently, the overall picture of rents improves.

The mechanism of rate determination is indeedinvolute

and wields far-reaching influences in characterizing an economy as just or otherwise. The relentless effort for its achievement has not yielded any praiseworthy success either in capitalist, socialist systems or even in Islam.

Although the pivotal role performed by morality in hammering out a just rate-determination framework is acknowledged here, the contribution made by economics is not to be overlooked.

Second Summary

Profit allotment to production tools, machinery, and the real estates, because of their contribution to the production process, is accepted and tolerated in accordance with innate logic. Meanwhile, profit generated over and above the ethical remunerations allowed to trade capital of a trader for his services is treated as usury. In the same manner, the illegitimate profit mobilized and employed by a capitalist in the production process and acting to swell his overall profit is considered to be impotent, and the new profit thus obtained and traceable to it is also illegitimate.

Our discussion has hitherto come to the point whereby insulated crystallized work can have three distinct manifestations:

First, production tools such as the spinning tool, which is the aftermath of work and ingeniousness of a person, annexed to the existing production means at his disposal and therefore helping enhance his productivity is apt here. The registered increase in the output is partly attributable to the newly introduced tool and partly to the accompanied labor in its utilization.

Secondly, work can be manifested as assets. An individual may manufacture a bicycle to facilitate greater mobility. Another individual may be interested in using the bicycle for a specified period of time for his needs. Therefore, the two may enter into an agreement according to which Mr. A, would lease his cycle to Mr. B. In another example, Mr. Amay

, through his own initiative and practicality, build a hut with a number of rooms more than enough to satisfy his personal needs. Given the above condition, he may lease the rooms to those who may be interested. In the last two examples, the bicycle and the hut, although by themselves, are not the origin of new consumption value, yet can act in that spirit and offer their own unique services.

Thirdly, trade capital neither helps to increase production, nor offers any consumption potential. It is injurious and its circulation sets in motion a cumulative process of capital accumulation for the capitalist; and therefore it is regarded to be impotent and barren.

In simpler words, profits stemming from the first and second types of capital, i.e., the productive and real estatecapital,

are acceptable explicitly and implicitly respectively. However, in the third type,i.e

, trading capital, no such resultant profit is defended logically and economically.

FormsOf

Capital In Islamic Contracts

Now we proceed to consider some Islamic economic contracts as compared with the three aforementioned situations so as to provide greater comprehension of their legitimacy or otherwise.

1. Lease:This tallies

with the second condition. A person who is in possession of a house, car or cycle may temporarily lease the same. The practice is free from any economic exploitation, and the terms are mutually negotiable by the parties. To counteract the mistaken notion that the practice may leave the tenant at the mercy of the landlord, we can state that in any socio-economic set-up, one of the primary objectives must be to overcome shortcomings.

Allowance of a free scope for the above mentioned practice would grant dynamism to construction activities, and the overall accommodation picture would improve and stabilize. At the same time, due response is extended to the accommodation needs of those who already possess their own private accommodation, but due to certain reasons are compelled to sojourn elsewhere. Of course the necessity of an apparatus to control the rents cannot be ignored. Likewise a person may develop a temporary need for using a car. He may, due to the nature of his life, need a car for only 10 days in a year. His individual exigencies, as well as those of the society, express themselves more favorable to availability of a car for him on a temporary basis, rather than purchasing it.

Therefore, we conclude that to overcome economic bottlenecks, the principle of controlled rates compounded with greater production of scarce economic items would not only violate economic justice but it would, on the contrary, also usher in an era of greater dynamism to the economy. By these two methods the probable misuses oflegitimation

of the lease which in turn leads to distanced incomes may also be encountered.

2.Muzareeh

(cultivation contract): Suppose that Mr. A carries out all the preliminaries such as construction of canals for irrigation and cleaning of a piece of land, etc., for cultivation. If he however, falls ill or goes on an unavoidable journey, he may enter into a contract with another individual called Mr. B for the completion of the work against a mutually agreed portion of the yield. Such contracts enjoy an essential justification and sanction. No doubt a mechanism to regulate the ratio of yields apportionment is necessary, but it cannot, in any manner, counter or eclipse the morality of the practice. Because Mr. B. in the absence of exertions made by Mr.A

prior to the commencement of his own work, could claim only a prospective yield of lesser magnitude.Supposing Mr. B puts in an approximate 3,000 hours in agricultural work.

Naturally, under conditions of an already tended land, his yield would turn out to be more. e.g..

30 tons instead of 10 tons.

Therefore a sharing of the yield in a just proportion between Mr. A and Mr. B, who have committed a division of labor, becomes both spontaneous and legitimate.

Hence, we can observe that the principle is innately logical. This condition precludes the possibility of exploitation of a farmer lacking arable land, seeds and machinery by another who enjoys greater advantages. This is enshrined in Article 43 of the Islamic Republic of Iran's Constitution.

The article acts to prevent the former farmer from being obliged to dispose of his labor cheaply and that, too, for a particular period. On the contrary, he can thoroughly examine the pros and cons of his venture, and if he finds it suitable, he can proceed with the deal.

Needless to say that for the smooth functioning of this principle, the condition of plentitude must be introduced in advance by the government. That is, plentitude of production facilities and better subsistence conveniences. Thus, it becomes perceptible here, the twin dimensions of economic liberty and non-exploitation, peculiar to Islam, are advocated and pursued.

3.Musaghat

(plantation contract):Musaghat

relates mainly to irrigation, and has more relevance to orchards and their like.Ifa

person possessed an orchard and he has to go on a journey, prior to his departure, he can strike a deal with another person to tend the trees and irrigate them on the condition of sharing the year's fruits. Here, the question of cultivation does not arise as in the case ofmuzareeh

.

4.Muzarebeh

(trading contracts): Trading contracts imply a merger of production and distribution processes. It existed, along withejareh

,musaghat

andmuzareeh

, and formed an indefectible part of human life even prior to the emergence of Islam. Ina countryside

, village-folks are engaged in specialized economic activities of diverse nature. One may be breeding cattle, another raising chickens, etc. As such, it becomes uneconomical for them to leave their work in the village in order to go to the city for purchasing those requirements not available locally. For example, it would not be economical for the cattleman to go to the city every now and then for the purchase of pots or sugar cubes. Therefore, the need for a middleman who could procure his required objects from the city would be conspicuously felt.Here.

a

peddler can perform the task by striking exchange deals between the city dwellers and the rural folks either in cash or in kind. In the case ofMuzarebeh

, the peddler does not pay any money to the first party, e.g. the potter, because he lacks money. He takes the pots from him, stipulates to dispose of them, and then on the basis of mutual consent, take a just share from the profit obtained.

Thus, here, the production work of the potter is combined with the service of the peddler to dispose of the goods, and a commensurate reward is allotted to the peddler. Here, unlike the trade capital profit, the reward thus gained by the peddler is a crystallization of concrete labor put in by the potter plus the service rendered by the peddler; and this is completely different from gaining profit by means of barren and unproductive capital.

The potter gives 10 of his pots to the peddler to sell for him in the village. The peddler sells the pots at a total price of 11 pots, and accordingly keeps the money for one pot, refunding the money for 10 pots to the potter.

Here, the potter has received money for his 10 pots and therefore no profit peculiar to trade capital has accrued to him. So, in the light of what we have just said about some special cases of economic contrasts in Islamic jurisprudence, we can only claim that what has been sanctioned in Islam as attainment of profit on capital is either through production capital or the real estate capital which proved to be acceptable. It is not profit attainment by capital atall,

rather it is the combination of productive and service labor.

But unfortunately up till now the absence of abundant investment opportunities and oppressive and unjust economic relations have led to the usurpation of surplus value which is a kind of invisible exploitation.

0%

0%

Author: Ayatullah Shaheed Dr. Beheshti

Author: Ayatullah Shaheed Dr. Beheshti